Pakistan’s recurring economic crises are often blamed on external shocks, global conditions, or technical weaknesses in economic management. A recent IMF Governance and Corruption Diagnostic suggests a deeper explanation: Pakistan’s economic instability is fundamentally a governance problem.

The report shows that corruption in Pakistan is not episodic or marginal – it is macro-critical. It weakens tax collection, distorts public spending, discourages private investment, and erodes public trust. While Pakistan has repeatedly implemented technically sound reforms under IMF programs, these reforms have struggled to endure because they were not embedded in credible institutions.

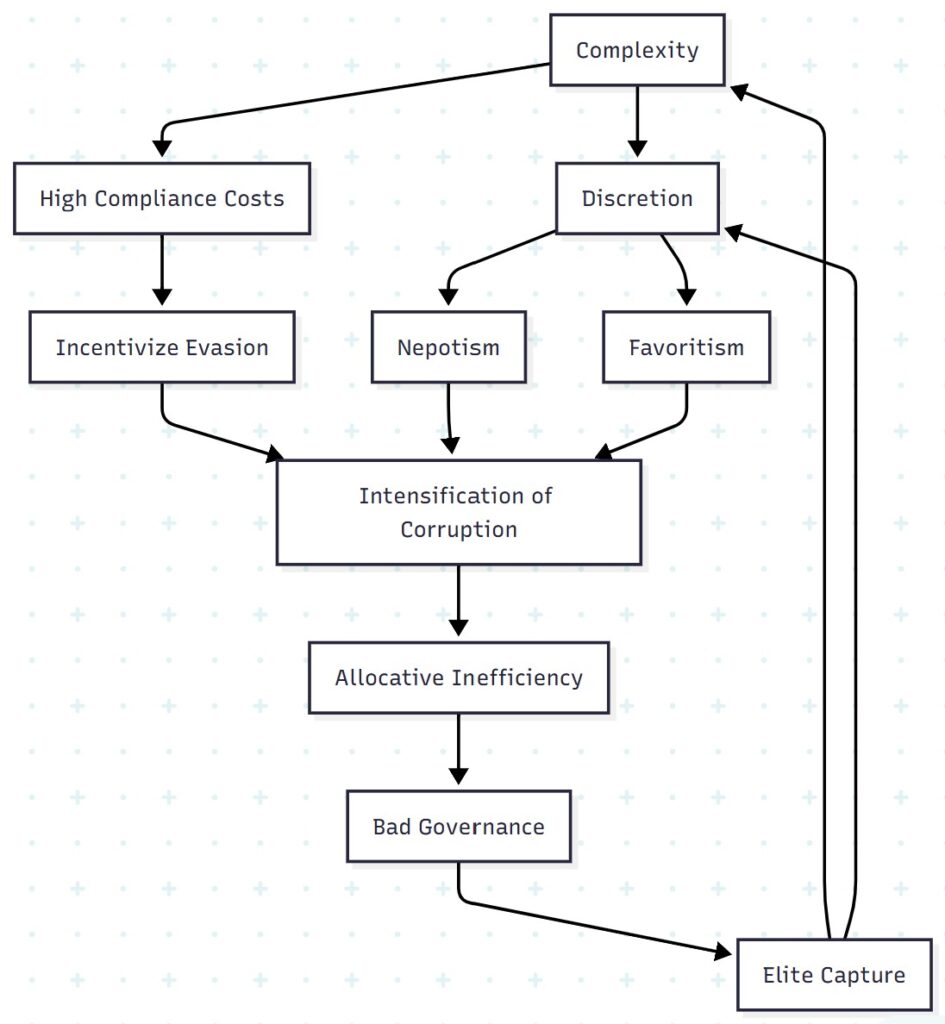

From a public finance perspective, the pattern is familiar. Complex tax systems with discretionary exemptions encourage evasion. Weak budget controls allow spending to drift far from parliamentary intent. Fragmented debt management obscures fiscal risks. Together, these factors undermine fiscal discipline and policy credibility.

The IMF’s analysis also highlights how market regulation and the rule of law affect economic outcomes. Businesses face heavy regulation but weak protection of contracts and property rights. Courts are overburdened, and enforcement is unpredictable. In such an environment, investment becomes short-term and defensive rather than productive and growth-enhancing.

Importantly, the report does not argue that Pakistan lacks institutions. It argues that institutions lack credibility. Anti-corruption agencies, auditors, and regulators exist, but fragmented mandates and perceptions of selective enforcement reduce their effectiveness. When accountability is inconsistent, citizens and firms adjust their behavior accordingly – lower compliance, lower trust, and lower expectations.

The IMF emphasizes gradual, rule-based reforms: simplifying taxes, strengthening parliamentary oversight, improving procurement transparency, and ensuring independence of oversight bodies. International experience suggests that such reforms take time but yield large dividends. For Pakistan, the payoff could be substantial – higher growth, greater fiscal stability, and restored confidence in public institutions.

Economic reform, the report implies, is not only about numbers. It is about rebuilding trust between the state and society. Without that trust, even the best-designed policies will struggle to deliver lasting results.